Treasurer Jim Chalmers has delivered his third Budget, prioritising boosting private sector investment to “fund and finance the future”.

After an expected second successive surplus of $9.3 billion for 2023-24, the Government is headed back into deficit for 2024-25 year, predicted to be $28.3 billion. The Government’s focus is to stimulate economic growth through encouraging businesses to invest, while maintaining cost-of-living relief balanced against a predicted easing of inflationary pressures.

Summary and highlights

We set out a summary of the key measures announced, and what they mean for you and your business.

See the following video for the highlights and read the complete summary below.

Alternatively, you can download a copy of the complete summary here.

For further details in relation to these announcements, Nexia will also be hosting an online briefing on the 2024 Federal Budget on Thursday, 16 May 2024. Register here.

2024 Federal Budget summary contents

Contents: Scroll to Individuals / Scroll to Businesses / Scroll to Future Made in Australia / Scroll to International / Scroll to other issues

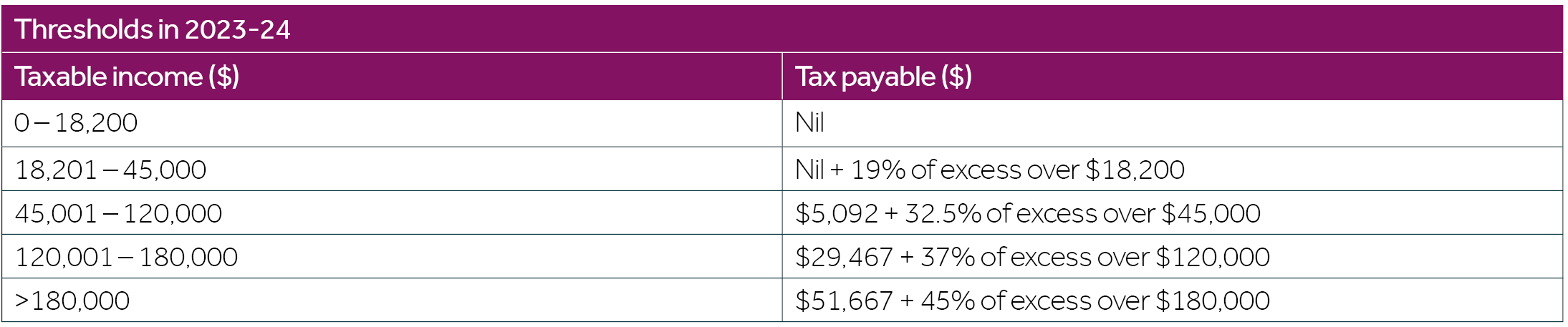

1. Recast Stage 3 tax cuts

The recasting of the State 3 tax cuts was legislated earlier this year, with the changes coming into effect from 1 July 2024. The new rates and thresholds will be as follows (excludes the 2% Medicare levy):

For 2024-25, where your income is below $37,500, the LITO (see item 2 below) has the effect of increasing the tax-free threshold to $22,575.

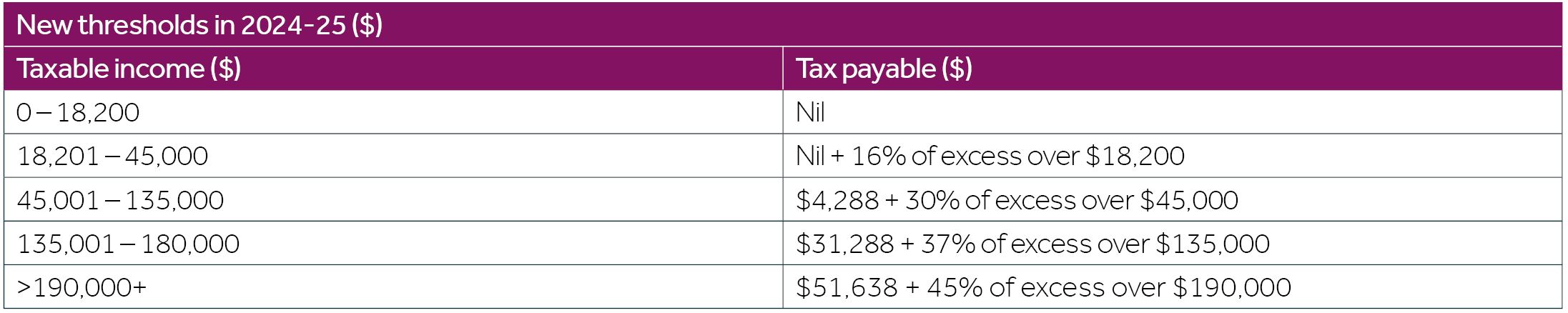

The approximate monthly reduction in income tax is summarised as follows:

2. Low-income tax offset

The Low-Income Tax Offset continues as $700, which tapers off as follows:

The LITO reduces to nil once your income reaches $66,667.

Contents: Scroll to Individuals / Scroll to Businesses / Scroll to Future Made in Australia / Scroll to International / Scroll to other issues

1. $20,000 instant asset write-off extended

The Government will extend this initiative for a further year, until 30 June 2025. For small businesses (group-wide turnover less than $10 million), the cost of eligible assets costing less than $20,000 (excluding any GST credit) that are first used or installed for use by 30 June 2025 will be fully deductible. The threshold of $20,000 will apply on a per-asset basis. Effectively, small businesses will be able to claim a tax deduction for the full cost of multiple assets.

The initial extension to 30 June 2024 is still yet to be legislated, and so we expect it will be retrospectively enacted along with this announced extension.

Assets costing $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business simplified depreciation pool and depreciated at 15% in the first income year and 30% each income year thereafter.

2. Energy bill relief

The Government will provide further energy relief to eligible small businesses in the form of a $325 rebate to be applied to energy bills in quarterly instalments from 1 July 2024. Rebate eligibility is contingent on small businesses meeting their state or territory’s definition of a ‘small customer’ as determined by their annual electricity consumption threshold. The thresholds differ across states and territories and are based upon annual consumption in MWh. Eligible small businesses will receive their energy bill rebate automatically and won’t be required to take further action.

Contents: Scroll to Individuals / Scroll to Businesses / Scroll to Future Made in Australia / Scroll to International / Scroll to other issues

1. Future Made in Australia program

1.1 Funding initiatives

The Future Made in Australia program brings together a range of new and existing manufacturing and renewable energy programs under a package of funding initiatives, totalling over $15 billion. The focus in on supporting local industry and innovation, especially in the renewable energy space.

The package of funding measures include:

- $1 billion for the Solar SunShot program to increase the number of Australian-made solar panels

- $2 billion for its Hydrogen Headstart scheme to accelerate the green hydrogen industry

- $470 million to build the world’s first “fault-tolerant” quantum computer in Brisbane, matching the Queensland government’s contribution

- $840 million for the Gina Rinehart-backed mining company Arafura to develop its combined rare earths mine and refinery in Central Australia

- $230 million for WA lithium hopeful Liontown Resources, which is also partly owned by Gina Rinehart

- $566 million over 10 years for Geoscience Australia to create detailed maps of critical minerals under Australia’s soil and seabed

- $400 million to create Australia’s first high-purity alumina processing facility in Gladstone

- $185 million to fast-track Renascor Resources’ Siviour Graphite Project in South Australia

- A $1 billion export deal to supply Germany with 100 infantry fighting vehicles, manufactured at Rheinmetall’s facility in Ipswich

1.2 Tax incentives

The Government will provide the following tax-related incentives relating to its Future Made in Australia program:

Critical Minerals Production tax incentive

A Critical Minerals Production Tax Incentive will operate from 2027-28 to 2040-41 to support downstream refining and processing of Australia’s 31 critical minerals to improve supply chain resilience, at an estimated cost to the budget of $7.0 billion over 11 years from 2023-24 (and an average of $1.5 billion per year from 2034-35 to 2040-41).

Hydrogen Production tax incentive

A Hydrogen Production Tax Incentive from 2027-28 to 2040-41 to producers of renewable hydrogen to support the growth of a competitive hydrogen industry and Australia’s decarbonisation, at an estimated cost to the budget of $6.7 billion over 10 years from 2024-25 (and an average of $1.1 billion per year from 2034-35 to 2040-41).

The Budget papers provide no specific details as to how these incentives will be implemented.

Contents: Scroll to Individuals / Scroll to Businesses / Scroll to Future Made in Australia / Scroll to International / Scroll to other issues

1. Strengthening foreign resident capital gains tax regime

The Government will strengthen the foreign resident capital gains tax (CGT) regime to ensure that Australia taxes foreign residents on direct and indirect sales of assets with a ‘close economic connection’ to Australian land, so that the rules are more in line with the tax treatment that already applies to Australian tax residents.

Very little details were provided in the Budget papers on how the measures will operate. However, the Government has announced that it will consult on amendments to apply to CGT events commencing on or after 1 July 2025 to:

- clarify and broaden the types of assets on which foreign residents are subject to CGT

- amend the point-in-time principal asset test to a 365-day testing period

- require foreign residents disposing of shares and other membership interests exceeding $20 million in value to notify the ATO, prior to the transaction being executed.

The Government is hopeful that the new ATO notification process will improve the current oversight and compliance issues with the foreign resident CGT withholding rules, where a foreign resident vendor self-assesses their sale is not taxable real property.

Contents: Scroll to Individuals / Scroll to Businesses / Scroll to Future Made in Australia / Scroll to International / Scroll to other issues

1. Strengthening tax compliance

The Government will seek to introduce a range of measures designed to improve compliance with Australia’s tax and superannuation systems. The measures will seek to improve compliance through a range of activities, including:

- Reducing the overclaiming of deductions e.g. excessive short-term rental property deductions

- Reducing the incorrect reporting of income

- Reducing inappropriate influence of tax agents

- Improving fraud detection and prevention e.g. extending the time the ATO has to notify a taxpayer that it intends to withhold a GST refund for further investigation from 14 to 30 days and rejecting illegitimate claims

- Assisting victims of fraud

- Reducing unreported activities of participants in the ‘shadow economy’ e.g. cash payments designed to evade GST and income tax liabilities

- Reducing tax avoidance by monitoring the compliance activities of entities with significant tax liabilities including multinationals, large businesses and high-wealth individuals.

2. Integrity, compliance and collection

2.1 Anti-tax avoidance rules

In last year’s Budget, the Government announced that the general anti-avoidance rules would be expanded to apply to schemes that:

- reduce tax paid in Australia by accessing a lower withholding rate on income paid to foreign residents; or

- achieve an Australian tax benefit even where the dominant purpose of the scheme is to reduce foreign income tax.

This year’s Budget states that these changes will apply to all income years commencing on or after the day the amending legislation receives Royal Assent, regardless of whether a scheme was entered into before that date. That is, these changes may apply to schemes that are already on foot.

2.2 Black economy

The previous Government had announced measures to give the Registrar of the Australian Business Register additional powers to cancel Australian Business Numbers as part of anti-black economy measures. These measures will no longer proceed as integrity issues are being addressed through enhanced administrative processes implemented by the ATO.

2.3 Tax refunds: old tax debts

The tax law will be amended to give the ATO a discretion to not use tax refunds to offset old tax debts that were put on hold prior to 1 January 2017, for individuals, small businesses and not-for-profit entities. This is consistent with the ATO’s current administrative approach.

3. Energy bill rebate

The Government commits to extending energy relief measures through to 2024-25 to ease cost of living stressors. From 1 July 2024, all Australian households are eligible for a $300 credit that will be automatically applied in quarterly instalments to their energy bills. Households in embedded networks (such as caravan parks, retirement villages, etc.) will be eligible for an equivalent rebate through an application to their state or territory government.

Contents: Scroll to Individuals / Scroll to Businesses / Scroll to Future Made in Australia / Scroll to International / Scroll to other issues

Final word

Following last year’s focus on cost-of-living and inflation, the Government is switching to promoting growth through a mixture of encouraging business investment and directly subsidising selected industries through its Future Made in Australia program.

However, the limited agenda for taxation and economic reform continues to hamper productivity growth and business incentive, contributing to the fiscal headwinds ahead.

Talk to your trusted Nexia Edwards Marshall NT Advisor about what any of the Budget announcements mean for you or your business.