Top Story

Assurance requirements – climate disclosures

The Auditing and Assurance Standards Board (AUASB) issued two new standards governing the assurance of climate disclosures:

- ASSA 5010 Timeline for Audits and Reviews of Information in Sustainability Reports under the Corporations Act 2001 – outlines the minimum assurance levels required for various components of an entity’s climate-related financial disclosures; and

- ASSA 5000 General Requirements for Sustainability Assurance Engagements – a stand-alone standard effective for financial years commencing on or after 1 January 2025.

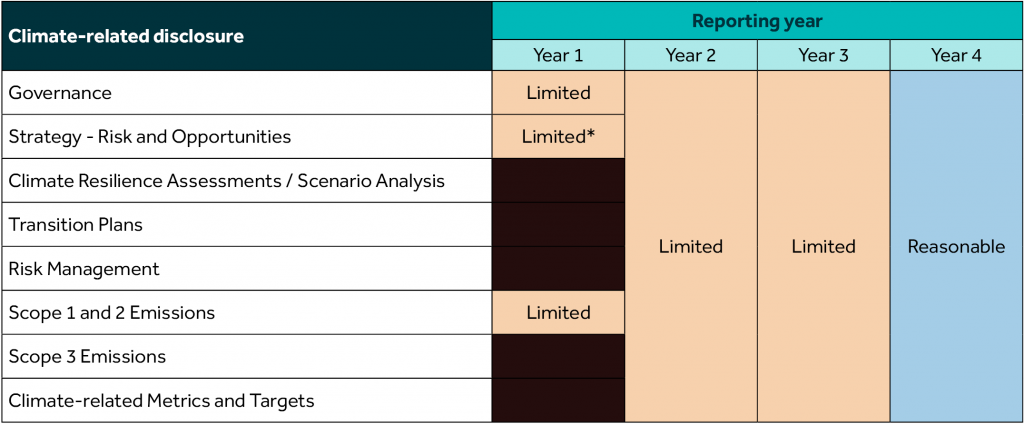

The assurance phasing prescribed by the AUASB is detailed in the following table:

* Only subparagraphs 9(a), 10(a) and 10(b) of AASB S2.

For statements where there are no significant climate-related financial risks or opportunities, the assurance timeline mirrors that of ‘Strategy – Risks and Opportunities’.

Local Reporting

AASB 2025-1 Amendments to Australian Accounting Standards – Contracts Referencing Nature-dependent Electricity

The Australian Accounting Standards Board (AASB) has issued AASB 2025-1, which amends AASB 9 Financial Instruments and AASB 7 Financial Instruments: Disclosures to improve the accounting and measurement of nature-dependent electricity contracts. These contracts enable businesses to procure electricity directly from renewable energy sources, where output varies due to natural conditions.

Key changes to the Standards include:

- clarifying the application of the ‘own-use’ requirements;

- permitting hedge accounting if these contracts are used as hedging instruments; and

- adding new disclosure requirements to enable investors to understand the effect of these contracts on a company’s financial performance and cash flows.

These amendments apply for annual reporting periods beginning on or after 1 January 2026, with early adoption permitted.

AASB addresses not-for-profit reporting issues

At its upcoming meeting on 6 – 7 March 2025 the AASB will

consider preliminary feedback received on:

- ED 334 Limiting the Ability of Not-for-Profit Entities to Prepare Special Purpose Financial Statements; and

- ED 335 General Purpose Financial Statements – Not-for-Profit Private Sector Tier 3 Entities.

The Board will also discuss the feedback received on ITC 5 Post-implementation Review of Not-for-Profit Topics – Control, Structured Entities, Related Party Disclosure and Preparation of Special Purpose Financial Statements.

AASB enhances Tier 2 financial instrument disclosures

At its upcoming meeting on 6 – 7 March 2025 the AASB is expected to approve amendments to AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities to require disclosure of quantitative and qualitative information relating to the effect of contractual terms that could change the amount of contractual cash flows based on the occurrence (or non-occurrence) of a contingent event that does not relate directly to changes in basic lending risks and costs (such as the time value of money or credit risk).

The amendments to AASB 1060 reflect similar amendments made to AASB 7 Financial Instruments: Disclosures contained in AASB 2024-2 Amendments to Australian Accounting Standards – Classification and Measurement of Financial Instruments in 2024.

Accountant’s letter toolkit updated

An accountant’s letter is a document prepared by an accountant to assist a client in securing loan, lease, or rental approval. It is also referred to as an ‘accountant’s declaration’ or ‘capacity to repay’ certificate.

To assist practitioners, CPA Australia, Chartered Accountants Australia and New Zealand, and the Institute of Public Accountants have updated their Accountant’s Letter Toolkit to reflect revisions in the 2025 Banking Code of Practice (the Code) which commenced 28 February 2025.

Clause 78 of the Code states, “We will not ask a third party (such as your accountant) to certify that you can repay the Loan”.

Regulations

NSW issues public sector climate-related disclosure framework

NSW Treasury released its minimum content requirements for the first year of mandatory climate-related financial disclosures for public sector entities for 2024-2025.

The framework outlines the first step to achieve more comprehensive climate-related financial disclosures. The framework is primarily based on AASB S2 Climate-related Disclosures.

At this point, the NSW Government does not require public sector entities to fully align with the Australian Sustainability Reporting Standards.

Sustainability

ISSB amends IFRS S2

At its meeting on 29 January 2025 the International Sustainability Standards Board (ISSB) agreed to issue an exposure draft to amend IFRS S2.

The proposed changes address identified application issues to:

- exempt from Scope 3 emissions reporting for derivatives, facilitated emissions from investment banking, and insurance-related emissions from underwriting activities;

- permit the ability to use alternative global warming potential (GWP) values;

- provide jurisdictional relief allowing the use of methods other than the GHG Protocol Corporate Standard to measure GHG emissions; and

- permit alternatives to the Global Industry Classification Standard (GICS) when disaggregating financed emissions by industry in certain circumstances.

The exposure draft is expected to be issued in the second quarter of 2025, with a 60-day comment period.

A podcast episode summarising the highlights of this meeting is available on the IFRS website.

Sustainability education materials

The ISSB released additional education materials to support first-time preparers of climate-disclosures. A recent release include:

- Applying IFRS S1 when reporting only climate-related disclosures in accordance with IFRS S2

- Using the GHG Protocol for climate-related disclosures

IFRS Developments

IASB Board Meeting – February 2025

During its February 2025 meeting, the IASB discussed its standard-setting projects covering:

- Financial Instruments with Characteristics of Equity

- Amortised Cost Measurement

- Intangible Assets

- Business Combinations — Disclosures, Goodwill and Impairment

The IASB will continue its discussions on these projects at future meetings.

The IASB also considered feedback on its proposals in the Exposure Draft Amendments to IFRS 19 Subsidiaries without Public Accountability: Disclosures. The IASB plans to issue these amendments in the second half of 2025.

A podcast episode discussing the highlights of this meeting is available on the IFRS website.

IFRIC update

The IFRS Interpretations Committee (IFRIC) published its final Agenda Decision regarding the Classification of Cash Flows related to Variation Margin Calls on ‘Collateralised-to-Market’ Contracts.

The matter related to how an entity presents, in its statement of cash flows, the cash flows related to variation margin call payments made on contracts to purchase or sell commodities at a predetermined price and at a specified time in the future.

The Committee concluded that the matter did not have widespread effect and decided not to address the matter.

In case you missed it

AML/CTF rules extend to accountants

The Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 (the Act) received Royal Assent on 10 December 2024.

The Act extends the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) regime to include services provided by real estate professionals, dealers in precious metals and stones, and professional service providers including accountants, legal practitioners, conveyancers, professional trustees and company secretarial services.

Relevant accountants’ services include:

- assisting a person to create or restructure a body corporate;

- acting as a director or secretary of a company;

- providing a registered office address or principal place of business address of a body corporate;

- assisting a person in a transaction to sell, buy or transfer a body corporate.

The amendments are effective from 31 March 2026.

The Impact Analysis prepared by the Attorney-General’s Department noted that the estimated total upfront and ongoing annual regulatory cost on the accounting services industry will be $562 million and $245 million, respectively. The government expects the additional compliance costs to be passed on to consumers.