On 27 March 2025, Treasury Laws Amendment (Tax Incentives and Integrity) Act 2025 received Royal Assent. Amongst other changes to the tax legislation, this Act denies the deductibility of Australian Taxation Office (ATO) issued general interest charge (GIC) and shortfall interest charge (SIC) incurred for income years starting on or after 1 July 2025. It is noted that while Royal Assent has been received, there is a possibility that the rules will be repealed if the Coalition Government wins this election.

This change is significant for taxpayers that have outstanding debts with the ATO. GIC applies for late payment and other obligations with the ATO. The current GIC rate (for the quarter ended 30 June 2025) is 11.17% annually. SIC applies for amendments to income tax assessments. It applies to income tax shortfalls for the period before assessments are amended. The current SIC rate (for the quarter ended 30 June 2025) is 7.17%. Both GIC and SIC apply on a daily compounding basis.

The change in law is intended to increase the collection of outstanding tax by the ATO. The higher interest rates, in addition to being denied deductibility, make outstanding debts with the ATO less favorable than finance provided by banks and other lenders.

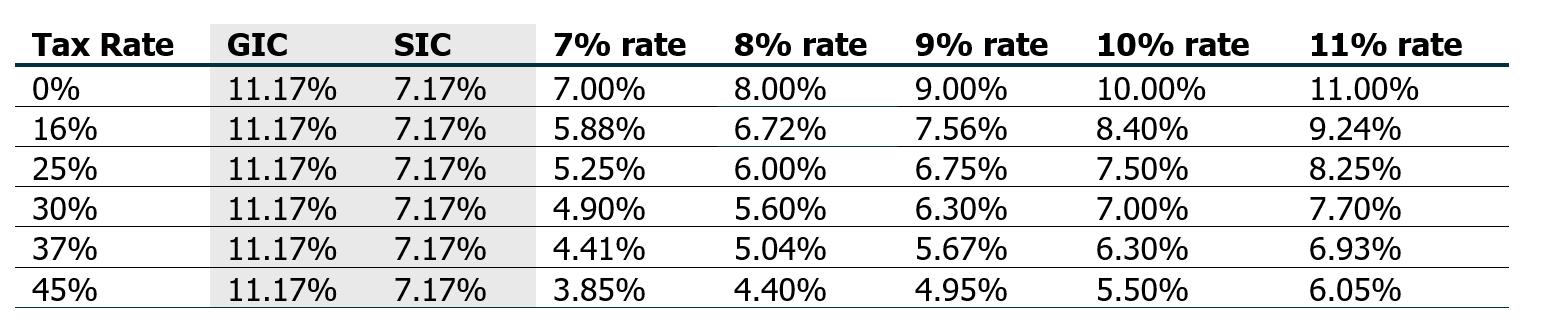

An example of the after-tax interest rate at the various tax rates and interest rates is considered below:

As can be seen, as the applicable tax rate increases, the after-tax rate (after allowing for the deductibility of interest) reduces. Therefore, while overdraft facilities or other lending options may have higher interest rates, once allowing for the deductibility of the interest they may present a lower cost funding alternative than retaining debts with the ATO.

For taxpayers with significant annual GIC and/or SIC costs, the denial of deductibility may lead to additional challenges. For example, where a trust has taxable income but no distributable income, tax may be assessed to the trustee at the top marginal tax rate.

Taxpayers should be proactive with the review of the tax affairs and considering financing alternatives.

Please contact your Nexia advisor for assistance to consider the impact of the change and the options available.