Welcome to the latest edition of our Not-for-Profit Newsletter. Please feel free to contact us if you have any questions about the content of this Newsletter.

In this edition

For those with 30 June year-end financial reporting requirements, this edition includes a summary of key financial reporting focus areas. Included is some information on a new Community Services Industry Scheme introduced by the NSW Government. We also cover several governance and compliance matters, and ACNC related items including a summary of governance standards that deal with how charities should operate.

Sections:

- Financial reporting

- Sustainability reporting

- Laws and regulations

- Wages underpayment

- ACNC activities

- Ethics

- NDIS

- Aged care

Financial reporting

ASIC financial-reporting focus areas

The Australian Securities & investments Commission has published its audit and financial-reporting focus areas for FY 2025-26

and highlighted the progress of its surveillance programs.

ASIC reviews financial reports and audit engagements of regulated entities, including publicly-listed companies, other economically significant public interest entities, for example, large proprietary companies, grandfathered entities, and registered superannuation funds. No specific mention is made of Australian Financial Services Licensees.

‘These surveillance programs aim to enhance the integrity and quality of financial reporting and auditing in Australia’, said ASIC commissioner Kate O’Rourke.

‘We expect all entities to provide reports and audits that are accurate, complete and informative.’

ASIC’s focus areas remain unchanged (see Appendix: ASIC’s ‘enduring’ focus areas for financial reporting – modified for NFPs) with one exception; revenue recognition has been added but no detail as yet. The commission will continue to focus on areas where significant judgement from preparers of financial reports is required. These include revenue recognition, asset valuation, and estimation of provisions.

ASIC cautions that ‘financial-report preparers should take extra care when making such judgements. especially considering recent capital market volatility’.

In 2022, the financial-report lodgement exemption for grandfathered entities was lifted. ASIC now monitors compliance of these financial reports with the legislative requirements and applicable accounting standards.

Some companies have failed to lodge reports since the exemption was removed. ASIC will follow up non-lodgements with companies and, if necessary, take appropriate regulatory action.

‘Many of these previously grandfathered entities are large companies and should be lodging financial reports. If the auditor is aware that a company is not complying with its lodgement obligations, [it] should inform ASIC through the appropriate channels’, Ms O’Rourke said.

Registrable superannuation entities were required to lodge audited financial reports with ASIC for the first time in 2024. The commission is finalising its review of around half of all lodged RSE financial reports and five RSE audit files.

In 2025-26, ASIC will review the other half of the RSE financial reports as well as a selection of RSE audit files. The focus areas for RSE financial reports include the measurement and disclosure of investment portfolios, and disclosure of marketing and advertising expenses.

Sustainability reporting in accordance with AASB S2 Climate-related disclosures will be mandatory for Group 1 entities with financial years commencing on or after 1 January that:

- Are required to prepare an annual financial report under Chapter 2M of the Corporations Act

- Meet certain sustainability reporting thresholds, and

- Have not obtained sustainability-reporting relief from ASIC.

The commission said that ‘impacted entities should begin work as soon as possible if they have not already implemented plans and procedures to meet the mandatory reporting requirements’.

ASIC will review 31 December sustainability reports as part of its 2025-26 program and share its observations with the market. The commission stated that it will take a proportionate and pragmatic approach to supervision and enforcement as sustainability requirements are phased in. Preparers of sustainability disclosures should refer to regulatory guide 280 Sustainability reporting for more information.

ASIC has updated information sheet 284 Public companies to include a consolidated entity disclosure statement in their annual financial report. The update reflects recent legislative amendments that clarify the tax-residency-disclosure requirements where entities are resident in more than one jurisdiction as well as when an entity is an ‘Australian resident’ for the purposes of 3 NFP Newsletter the consolidated-entity disclosure statement, including partnerships and trusts.

The update is relevant to public companies and applies to annual financial reports for financial years commencing on or after 1

July 2024.

Current and non-current liabilities – what do we need to consider?

The strength of a balance sheet and whether current assets exceed current liabilities is used as an indicator of an entity’s financial position.

Changes to AASB 101 Presentation of Financial Statements, which are effective for 30 June reporters for the first time from 2025, could cause the presentation of some liabilities to change and also provide users with more information about in-place covenants.

A current liability is one where the entity does not have the right to defer settlement for at least 12 months at the reporting date.

Let’s look at the considerations for 30 June and beyond.

Do you or your client have any financing arrangements? If so, have you documented expiry date of the facility, conditions for any rollovers, covenants attached to the financing arrangements, and details of and dates of testing of covenants, and consequences of covenant breaches?

Where the covenants are tested on or before year-end, have they been met? If yes, then classify the liability using the traditional current and non-current rules. If no, then generally the liability is classified as current.

Where the covenants are tested after year-end, compliance with these covenants do not affect the presentation of the liability at year-end, however AASB 101 now includes the nature and description of these covenants and whether facts and circumstances might indicate that the entity will have difficulty complying with them.

When a covenant is breached at the reporting date, generally an entity does not have a right to defer settlement of the associated liability for at least 12 months, which means the liability must be presented as current. If before year-end, the entity has received a waiver or period of grace from the financial institution, then this may not be the case.

A waiver effectively ignores the breach and therefore the liability can be presented in accordance with the usual requirements in AASB 101.

A period of grace provides time for an entity to try to solve the breach, to avoid presentation of the liability as current, and the period of grace needs to be at least 12 months after the reporting date.

Unless the waiver or period of grace is received before year-end, it will not affect the presentation of the liability, however disclosure of the receipt of the waiver and period of grace post year-end would be included as a non-adjusting event.

The disclosures requirements relating to covenants tested after the reporting period in AASB 101 are new and will require careful consideration.

Entities will need to ensure that the level of disclosure around the nature of covenants provides the relevant information to users without providing commercially-sensitive information.

Identification of facts and circumstances that may indicate that an entity will breach a future covenant can be challenging, however entities will need to consider current management accounts, budgets and forecasts and any expected cyclical results.

AASB 101 also notes that if the covenants would not be met at year-end (even though it does not need to be) then this should be disclosed in year-end financial statements.

Audit planning and risk responses should be updated to reflect these financial reporting changes

New standards for 30-June reporters

New standards for 30-June reporters are:

AASB 2022-5 Amendments to Australian Accounting Standards – Lease Liability in a Sale and Leaseback

AASB 2023-1 Amendments to Australian Accounting Standards – Supplier Finance Arrangements (AASB 2024-1 is Tier 2 version), and

AASB 2022-10 Amendments to Australian Accounting – Fair Value Measurement of Non-Financial Assets of Not-For-Profit Public Sector Entities.

CA ANZ has updated its guide Financial reporting and auditing in uncertain times, which stresses key focus areas.

ASIC’s tips to improve reporting

Report 799 ASIC’s oversight of financial reporting and audit 2023-2024 summarised findings from 1 July 2023 to 30 June 2024. It highlighted areas where the quality of financial reporting and audits could be improved.

ASIC says that audit committees, directors, and preparers of financial reports have a critical […] role in supporting quality financial reporting and audits and it is in their interest to support the audit process.

Key building blocks to supporting high-quality outcomes include:

- High-quality and timely financial information supported by robust position papers with appropriate analysis and conclusions

referencing relevant accounting standards - Adequate resources, skills, and expertise being applied in the reporting process. Comprehensive contemporaneous position papers should support conclusions reached, particularly in areas that have significant estimation uncertainty and judgement (for example, asset values, revenue recognition and provisions)

- Clear, effective communication with the auditor addressing risks affecting the information in the financial report, and

- Robust auditor selection with accountable procedures, appropriate audit fees, and clear communication channels between the auditor and the audit committee.

Sustainability reporting

Guidance on disclosures about transition plans

The IFRS Foundation has published Disclosing information about an entity’s climate-related transition, including information about transition plans, in accordance with IFRS S2 as part of its commitment to supporting the implementation of IFRS sustainability disclosure standards.

The guidance:

- Supports entities applying IFRS S2 Climate-related Disclosures

- Is designed to enable entities to provide high-quality information about their climate-related transition when applying IFRS

S2, and - Covers disclosures about transition plans, including both mitigation and adaptation efforts.

Although IFRS S2 does not require an entity to have a transition plan, it does require it to provide material information about the sustainability-related risks and opportunities that could reasonably be expected to affect its prospects. This includes information about climate-related transition because it relates to how an entity mitigates and adapts to the change.

The document:

- Explains that an entity’s climate-related transition is a process through which the entity, in the context of its overall strategy, pursues targets, undertakes actions and deploys resources to respond to climate-related risks and opportunities

- Explains what it needs to disclose in applying IFRS S2, if the entity has a strategy for its transition to a lower-carbon and/ or climate-resilient economy (for example, reducing its greenhouse gas emissions and adjusting its business model to become more resilient to climate-related physical risks), and

- Sets out guidance on disclosures about entities’ climate-related transitions.

The document complements materials provided by jurisdictions or others that set out requirements or recommendations to create transition plans and their contents.

Laws and regulations

Community-services long-service scheme begins

Workers in community services change employers. They don’t always have 10 years of service with a single employer to qualify for long-service leave.

The NSW Government has addressed the issue by bringing in on 1 July portable long-service leave known as the Community Services Industry scheme.

Under the scheme, workers become eligible for long-service leave after seven years of service to the industry. Eligible workers can claim up to six weeks’ long-service leave, payment based on wages (not including overtime). It doesn’t need to be taken immediately or all at one time.

In some cases, such as a worker permanently leaving the industry, employees may be eligible to apply for a pay-out of their long-service leave. The new scheme will be supported via a levy paid quarterly by eligible employers and any self-employed contractors who opt-in.

Employers with one or more workers will be required to register with the Long Service Corporation and begin recording worker service.

Lodgement of service returns and levy payments for the first three quarters will be due from April 2026, giving employers time to prepare quarterly service returns and budget for levy payments. Worker registrations begin from April next year.

Workers who appear on the first two service returns (1 July to 31 December) will receive an automatic foundation-worker bonus of 365 days of service credits.

The scheme does not override requirements of the Long Service Act 1955. Under the act, employees are entitled to long-service leave if they work for a single employer for 10 consecutive years.

For more detailed information refer to the Long Service Corporation website.

Wages underpayment

Townsend House signs enforceable undertaking

A South Australian allied health-services charity has signed an enforceable undertaking with the Fair Work Ombudsman to improve its workplace compliance. It underpaid workers more than $76,000.

Eighty employees were underpaid base and overtime rates between September 2017 and October 2022 that were owed under the charity’s enterprise agreements. Townsend House Inc self-reported non-compliance to the FWO in April 2023.

Townsend House advised that the underpayments were due to having misunderstood the treatment of additional hours employees had worked. There were also payroll errors.

The FWO’s investigation to check the integrity of the charity’s remediation program uncovered a failure to comply with an undertaking Townsend House had given in 2018 to the Fair Work Commission (different from the FWO) as part of its approval of the enterprise agreement. The undertaking was about overtime rates it would pay to part-time employees.

The charity has back-paid $76,804 to 26 current and 54 former employees. The sum includes almost $11,000 in interest and about $1500 in superannuation.

Fair Work Ombudsman Anna Booth said: ‘Employers must prioritise workplace compliance and ensure all their systems and processes align with the legal requirements of their own enterprise agreements, as well as any relevant awards and undertakings.

‘We urge employers to take advantage of the array of free information and tools available on our website, such as our pay calculator.’

As part of the EU, Townsend House must have relevant staff undertake workplace-relations training that will cover national employment standards and minimum requirements under applicable industrial instruments.

Townsend House must also commission an independent audit of its workplace compliance and report its findings to the FWO, provide for forums that can report on issues and can accommodate union representatives if members wish to invite them, and commit to reviewing and amending its internal processes for reporting workplace-relations issues to its board.

The EU acknowledges that Townsend House has already introduced a new payroll system, outsourced payroll to a specialised provider, established a new governance structure and updated its constitution, and established a forum for employees to discuss workplace-relations issues with management.

FWO issues payroll guide

The FWO has issued Payroll Remediation Program, a guide designed to help employers and their representatives identify and correct underpayments of employee entitlements under the Fair Work Act.

The guide includes information on:

- Diagnosing a problem and designing a large-scale employee-centred remediation program

- Managing employee communications

- Finding and paying former employees, and

- What employers should expect if they self-report to FWO.

The ombudsman expects the guide to enhance improved compliance.

ACNC activities

Cyber threats are real

The Australian Charities and Not-for-profits Commission has released key findings of a review into cyber-security and its associated risks for charities.

The review identified key areas where charities could strengthen governance to minimise risks and manage a cyber incident.

ACNC commissioner Sue Woodward said that the threat of attack is real, and the risks are significant.

She added: ‘Nearly all charities, small and large, hold sensitive personal data such as the names and other details of donors, members, volunteers, staff, and the people who use their services. This information can be taken and misused if there is an attack on […] systems.

‘Cyber-attacks can lead to financial losses for those [the charities] serve as well as reputational and financial damage […]. It can also harm public trust and confidence in the charity sector more widely.’

Charities are obliged to ensure good governance minimises risks. They must also be prepared to act quickly and effectively if incidents occur, she said.

‘It is heartening that most charities that took part in this review had satisfactory cyber-security governance in place. Importantly, these reviews provide deep insights into exactly how they are managing risks, highlighting effective actions and policies,’ said Ms Woodward.

‘We share these insights so people involved in running charities can see both effective practices and learn from where things are not being done well – it’s part of our education and support for good charity governance.’

The review found charities achieved satisfactory cyber-security governance by:

- Having robust information and data-management policies and procedures

- Having governance that enabled and supported board members to drive strong cyber-governance practices

- Promoting a strong culture of cyber-security awareness to ensure the charity’s people understood common cyber-threats and best-practice measures to manage them

- Drawing on the latest cyber-security resources, tools, and advice freely available online through various lead agencies and organisations, and

- Understanding risks in each charity’s unique operating environment and taking steps to manage them.

The review also addressed the particular risks entailed in using artificial intelligence.

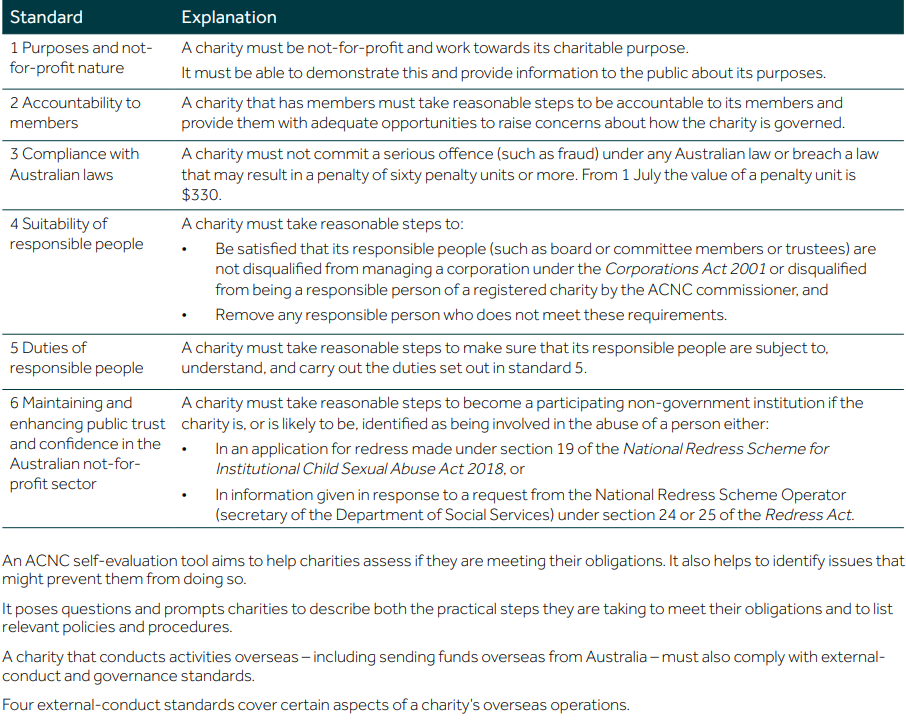

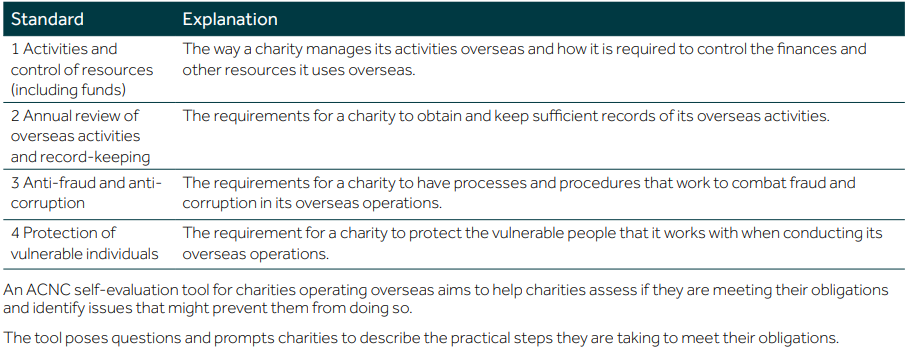

Adhering to ACNC’s governance standards

The ACNC’s governance standards are core principles dealing with how a charity should be run.

Charities must meet the standards to be — and remain — registered. The principles do not apply to basic religious charities.

They require charities to remain charitable, operate lawfully, and be run in an accountable and responsible way. They help to maintain public trust in charities’ work.

The principles are high-level, imprecise rules, and charities must determine what they need to do to comply with them.

Know the charity sector

Revenue raised by charities has reached a record $222 billion, the 11th edition of the ACNC’s Australian Charities Report shows.

The sum is based on submissions by charities to the commission for the 2023 reporting period. The rise in revenue of more than 10 per cent exceeded the rise in expenses, which grew by 8.4 per cent to $212 billion.

The sector employed more than 70,000 more people compared with the previous period – 1.54 million or 10.7 per cent of the Australian workforce. More people work in charities than in construction and manufacturing industries.

Staff were the biggest expense, accounting for 55 per cent of total expenses.

Very small charities (with annual revenue of less than $50,000) made up more than 30 per cent of the sector but generated only 0.1 per cent of total revenue. In contrast, the biggest charities (with annual revenue of $100 million or more) comprised just 0.5 per cent of the sector but accounted for 56 per cent of total revenue. Their revenues rose by 14.2 per cent, accounting for $15 billion of the $21 billion increase in total revenue.

Charities’ shares of donations and bequests differed markedly. About 40 per cent of the total went to just 30 charities. Donations comprised around 40 per cent of extra-small charity revenue compared with only slightly more than 6 per cent for those deemed extra-large.

While total donations and bequests jumped by $5 billion to $18.9 billion, this was almost entirely due to a $4.9 billion donation to the Minderoo Foundation group – the largest single gift ever reported to the ACNC.

Donations rose by less than 0.4 per cent, or $54 million. Just over half (56 per cent) of extra-small organisations received donations and bequests – down from 66 per cent previously.

There were 2.4 volunteers for every employee. Volunteer numbers jumped to around 3.77 million – up by almost 270,000.

It approached the highest number of volunteers, which was recorded in the sixth edition of the report in 2018. More than half (52 per cent) of all charities had no paid staff. For extra-small organisations the figure was nearly 90 per cent.

Hundreds of charity registrations revoked

The ACNC has revoked the registration of 627 charities after they failed to submit two or more annual information statements.

The action follows final reminders sent to 814 charities, warning them that they had until 20 May to comply with their reporting obligations or face deregistration.

Failure to report not only leads to loss of registration with the ACNC but also forfeits a charity’s eligibility for certain commonwealth tax concessions.

Can promoting sport be charitable?

The ACNC has published a new ‘registration-decision’ summary that discusses registering sporting organisations.

The summary focuses on an organisation that applied to the ACNC for registration as a charity. Its purpose was ‘engaging in community sport’. Generally, the purpose of promoting sport is not a recognised charitable purpose.

However, where sporting activities are promoted to further a charitable purpose, the charity might be registrable.

The summary outlines how the ACNC sought to gain a greater understanding of the organisation’s work – including how it pursued its object of creating sports events in practice – and how this understanding helped to inform the ACNC’s decision-making.

Another ACNC summary focuses on what the commission looks at when considering if an organisation’s purposes are charitable or incidental or ancillary.

It demonstrates the ACNC’s reasoning when organisations have purposes that might or might not be charitable.

Tax self-assessment guidance for NFPs

The senate Standing Committee on Economics has reported on the ATO’s implementation of the requirement for NFPs to lodge an annual return to confirm their eligibility to self-assess as income-tax exempt.

It recommends that:

- Thresholds be introduced to exempt smaller NFPs from the self-assessment lodgement requirement

- The deadline for lodgement (31 March) be extended

- The ACNC manage the self-assessment lodgements instead of the ATO

- The ACNC and the ATO harmonise their guidance to NFPs, and the commission updates its online information on factors affecting charity registration, and

- The ATO undertakes consultation with the NFP sector to resolve challenges and uncertainty in self-assessing and to improve services supporting NFPs to do it.

Ethics

APESB issues code amendments

The Accounting Professional & Ethical Standards Board Ltd has issued a new ‘compiled’ code for APES 110 Code of Ethics for Professional Accountants (including Independence Standards).

The changes incorporate the following amending standards:

- Amendments to Part 4B Independence for Assurance Engagements other than Audit or Review Engagements of APES 110 (effective 1 July 2021)

- Amendments to APES 110 to Promote the Role and Mindset Expected of Professional Accountants (effective 1 January 2022)

- Amendments to APES 110 Addressing the Objectivity of an Engagement Quality Reviewer and Other Appropriate Reviewers (effective 1 January 2023)

- Amendments to fee-related provisions of APES 110 (effective 1 January 2023)

- Quality-management-related conforming amendments to APES 110 (effective 1 January 2023)

- Amendments to non-assurance services provisions of APES 110 (effective 1 July 2023)

- Revisions to APES 110 Relating to the Definition of Engagement Team and Group Audits (effective 1 January 2024)

- Revisions to APES 110 Relating to the Definitions of Listed Entity and Public Interest Entity (effective 1 January 2025)

- Technology-related revisions to APES 110 (effective 1 January 2025), and

- Revisions to APES 110 addressing tax planning and related services (effective 1 July 2025).

NDIS

NDIS triples compliance and enforcement

The NDIS Quality and Safeguards Commission has announced that it has more than tripled compliance and enforcement actions against NDIS providers and individuals between January and March compared with the previous quarter.

The commission delivered 6841 compliance and enforcements in the March quarter, including:

- Five banning orders against registered and unregistered providers and 55 banning orders against individuals deemed unsuitable to work with people with disability

- 1108 refusals of registration due to failure of providers to pass a suitability assessment by the applicant and/or its key personnel

- 1036 corrective-action requests, which formally require actions by NDIS providers to address their non-compliance with laws, regulations, and conditions of registration, and

- More than 4000 education activities undertaken with providers that breached conditions of registration, including audit requirements.

NDIS quality and safeguards commissioner Louise Glanville said: ‘As the regulator of the NDIS, we are dedicated to upholding the rights of people with disability and ensuring NDIS providers and workers are held to the highest standards.

‘We are committed to using our full suite of regulatory powers to improve the quality, safety, and accountability of NDIS supports and services.’

Bans were issued to individuals for sexual offences, abuse and exploitation of NDIS participants, child neglect (which the NDIS commission determines makes an individual unsuitable to work in the scheme), and substance misuse that affected the ability of an individual to safely support NDIS participants.

Further to these individual bans, a joint investigation by the commission and the National Disability Insurance Agency resulted in the Freedom Care Group being banned permanently in March for fraudulently claiming $340,000 for supports and services for participants who were incarcerated.

Other significant action taken against providers included a 10-year ban of Assistive Disability Services and three-year bans for The Australian Health Company and The Foot Specialist Australia.

A significant increase in corrective and education letters issued demonstrated an increased focus by the NDIS commission on ensuring that providers are complying with audit conditions.

Horizon Solutions permanently banned

The NDIS Quality and Safeguards Commission has permanently banned Horizon Solutions Australia Pty Ltd, operating as Cocoon SDA Care, and its director Muhammad Latif from providing support and services to people with disabilities.

The ban came into effect on 7 June and superseded a suspension notice issued against Horizon on 9 May. Horizon’s application or renewal of registration has also been refused.

The decision follows a detailed investigation that uncovered serious and systemic misconduct, including improper and false service claims for participants who were deceased or incarcerated, and unlawful breaches of participant privacy.

NDIS quality and safeguards commissioner Louise Glanville said the NDIS commission is committed to upholding the human rights of NDIS participants and will not tolerate misconduct by providers that puts participants at risk.

‘Horizon has grossly violated the trust placed in them by participants, families, and frontline staff – this was nothing less than callous and deliberate abuse of a system designed to support dignity, independence, and fairness for people with disability’, she said

‘Our investigation found Horizon repeatedly breached the NDIS code of conduct by failing to act with integrity, honesty, and transparency. We also identified service failings that demonstrated this provider is not competent to deliver NDIS services and supports.

‘A permanent ban on the company and its director prevents any future access to NDIS funds and sends a strong message to the community that fraud and exploitation will not be tolerated.’

‘The ACCC is actively investigating [many] NDIS providers for contraventions of the Australian consumer law and anticipates taking public enforcement action in the near future.

‘All businesses supplying goods and services to NDIS participants should urgently review their advertising and ensure they are acting in compliance with the Australian Consumer Law.’

Former NDIS providers jailed

Two former NDIS Sydney providers have been jailed for offences involving $1.2 million in fraudulent claims, including for services

never provided.

The successful prosecutions were the result of Fraud Fusion Taskforce investigations.

A woman who operated a cleaning business as a registered provider in Kellyville in Sydney’s north-west was found guilty in the NSW District Court of deliberately claiming payment for household tasks and cleaning services, knowing that they were never provided.

The 41-year-old faces a total of three years and six months behind bars, with a non-parole period of one year and five months after she was found guilty on two counts of 88 fraudulent payment requests valued at more than $1 million submitted between 2018 and 2020.

The woman has also been ordered to repay $442,977 to the commonwealth.

The NDIA investigated the cleaning business after receiving tip-offs from the public and worked closely with the Australian Federal Police to execute a search warrant at the woman’s home, seizing documents and electronic devices. Her sentencing comes after another woman in a separate case was earlier this month jailed for three years with a one-year non-parole period after she was found guilty of dishonestly obtaining a financial advantage from the commonwealth.

The 48-year-old pleaded guilty in the NSW District Court to two counts of fraud consisting of eight offences committed in 2019 and 2020 and totalling more than $200,000. She must repay the commonwealth $51,733.

The sentencing was the result of an investigation by the NDIA into two registered NDIS provider businesses operated by the woman in western Sydney in 2020.

During the investigation, the woman left Australia for the United Arab Emirates. She was arrested and charged upon re-entering the country in 2022. NDIA CEO Rebecca Falkingham said the verdicts showed that providers who set out to exploit the scheme and participants would be caught.

‘These cases involved unscrupulous providers taking advantage of NDIS participants and claiming payments for services that they knew were never provided […]’, Ms Falkingham said.

‘While most providers do the right thing, dishonest operators will be brought to account.

‘The two cases reflect the agency’s strong actions to protect the integrity of the scheme to ensure every NDIS dollar goes towards participant outcomes.

‘We have zero tolerance for fraud – and any inappropriate conduct – committed against the NDIS and its participants.

‘People with disability and their families deserve to be protected from exploitation, and we are committed in ensuring those expectations are met.’

The Fraud Fusion Taskforce includes 23 agencies and has launched more than 630 investigations since 2022. The agency’s Crackdown on Fraud program has further strengthened the integrity and security of the scheme.

Aged Care

New aged-care era begins soon

The new Aged Care Act begins on 1 November, giving aged-care providers time to prepare their clients, support their workers, and get their systems ready for the changes.

The date gives more time to finalise key operational and digital processes and for parliament to consider supporting legislation that will enable the new act to operate effectively.

The act includes, for the first time, a statement of rights for older people and a statement of principles to guide how providers and workers must behave and make decisions.

A Support at Home program, which supports older people to remain healthy, active and connected to their communities, will begin with the act. Until then, the Commonwealth Home Support Program, Short-Term Restorative Care Program and Home

Care Packages Program will continue to support older Australians who wish to continue living at home.

The new act follows the introduction of star ratings, more direct care for more than 250,000 older people in aged-care homes, 24/7 nursing in homes, higher wages for aged-care workers, a new single assessment system, more transparency about provider finances and operations, and higher standards for people working in the aged-care sector.