Sometimes, life happens where things don’t work out. Relationship breakdowns are never easy, and the last thing anyone wants is to find out that their property settlement comes with an unexpected tax liability.

When a property settlement occurs, assets often are transferred from one legal owner to another. This transfer can trigger a capital gains tax liability under normal circumstances, but tax law allows for a deferral of this liability in the case of a relationship breakdown. If the conditions are satisfied, the deferral is automatic. So, although there might not be a tax impost now, there may be one in the future.

During the process of negotiating a property settlement, both parties need to agree on the value of each asset in the pool. This raises the question of whether an asset’s value should be discounted due to any future tax liabilities embedded in that value.

Some assets are more equal than others

Imagine a couple’s asset pool comprises the following, with a total value of $4 million:

- $1 million in a joint bank account

- $1 million in a company bank account, representing retained profits

- The family home with a value of $1 million

- An investment property with a value of $1 million

Each asset has a headline value of $1 million. If each spouse takes two of the above assets, that’s an even division of $2 million each. However, some of those headline values may have an underlying future tax cost embedded in them.

The joint bank account and the family home might reasonably be attributed their $1 million value each. The reason is that the money is clear funds, and the house, if sold now, may well be fully exempt from tax. You would get the full $1 million worth of use out of those assets.

The same cannot be said for the money in the company bank account and the investment property. The reason is that those assets, when turned into cash in your hands, may come with a tax liability. For example, a capital gains tax liability might arise upon selling the investment property. The only realistic way to receive the company money permanently is to pay a dividend, which would likely trigger an income tax liability. Thus, those assets’ headline values have a future tax liability embedded in them. That is, you would get less than $1 million worth of use out of those assets.

When to discount headline values

So, when should a future tax liability discount an asset’s headline value for dividing up the asset pool?

There is a case law precedent to guide this determination. When valuing an asset, it is important to consider the likelihood of a contingent tax liability. If the tax liability is expected to materialise in the foreseeable future, the asset’s headline value ought to be reduced. However, if the asset is anticipated to be held for the long term, the case for factoring in a future tax liability lessens. This can be challenging between the parties, as it might entail assertions of future behaviour.

When an asset’s value ought to be reduced due to an expected future tax liability, the parties must agree on measuring the liability, considering various factors and agreeing on assumptions. Once the discounted value of the asset is determined, it will be used in the property settlement calculations, regardless of any future changes.

Loan accounts in entities

You might have taken money out of an entity as a loan, which you still owe to the entity, or perhaps you put money into that the entity and it still owes you. Or maybe a trust appointed trust income to you, which it hasn’t paid out, and you have an unpaid present entitlement owing to you. These loan accounts and unpaid present entitlements can be a bit of a mystery to some as to what they represent and what to do with them.

These amounts on entities’ balance sheets have real tax and commercial consequences and must be considered to avoid unexpected outcomes. There is nothing magical about how to go about addressing these, but they need to be addressed for a property settlement to be tax and commercially effective.

Capital gains tax (CGT) deferral

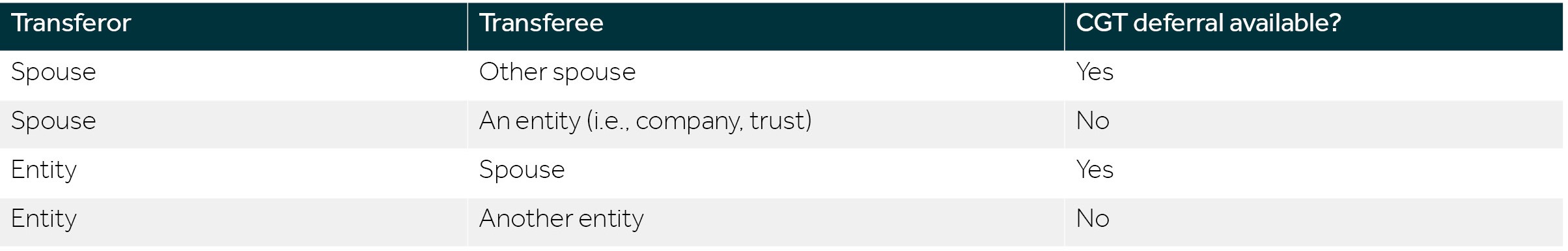

A roll-over is available to defer any CGT that would otherwise arise upon transferring assets in circumstances of a relationship breakdown. Conditions need to be satisfied, but here is the broad availability:

An example of an entity transferor is a company controlled by one or both spouses that owns a property that will be transferred to one of the spouses. It can be seen that the CGT deferral is available only when the transferee is a spouse (in their personal capacity). Although the CGT rollover might be available upon transferring an asset from an entity to a spouse, the extraction of the asset’s value from the entity – like in the company example above – may cause an income tax liability to arise. This must be carefully planned.

Where it is desired to transfer an asset to an entity, any capital gain triggered cannot be deferred. However, other concessions, such as the small business relief concessions, might be available to reduce the capital gain.

There are also concessional rules to alleviate stamp duty, and the GST consequences must also be considered.

Planning is the key

It is clear that planning in advance is essential to ensuring any tax challenges are identified and contingent tax liabilities are agreed upon where appropriate. That is the key to negotiating a property settlement with the confidence that any future tax liability has been factored in.

Speak with your trusted Nexia Edwards Marshall NT Advisor if you have any questions about the matters discussed in this article or how we can help you navigate your tax obligations and identify opportunities.