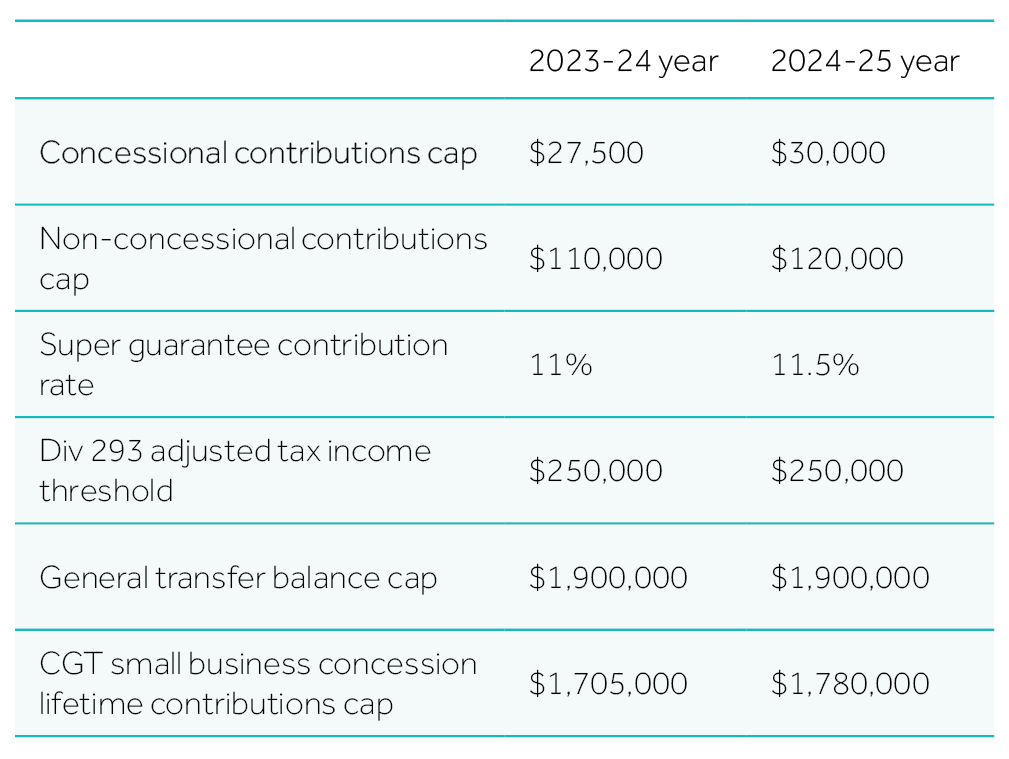

We summarise a number of important superannuation rates and caps for your convenience, especially where they have changed from 1 July 2024.

Minimum pension factors

In the year a pension commences:

If pension is commenced before 1 June, the minimum is prorated by the number of days in the financial year that includes and follows the commencement day.

If pension is commenced between 1 June and 30 June, no minimum payment is required.

In the year of a commutation the minimum is prorated by the number of days in the financial year up to the date of commutation.

A pre-commutation minimum payment is not required if:

- The commutation is a partial commutation and the remaining account balance is enough to meet the minimum payment, or

- The commutation results from death, family law split, surcharge payment or exercise of right under a financial product cooling off period.

In addition to the above minimums, transition to retirement pensions are subject to a maximum annual drawdown of 10% of the opening account balance, which is not prorated.

2024-25 Individual tax rates

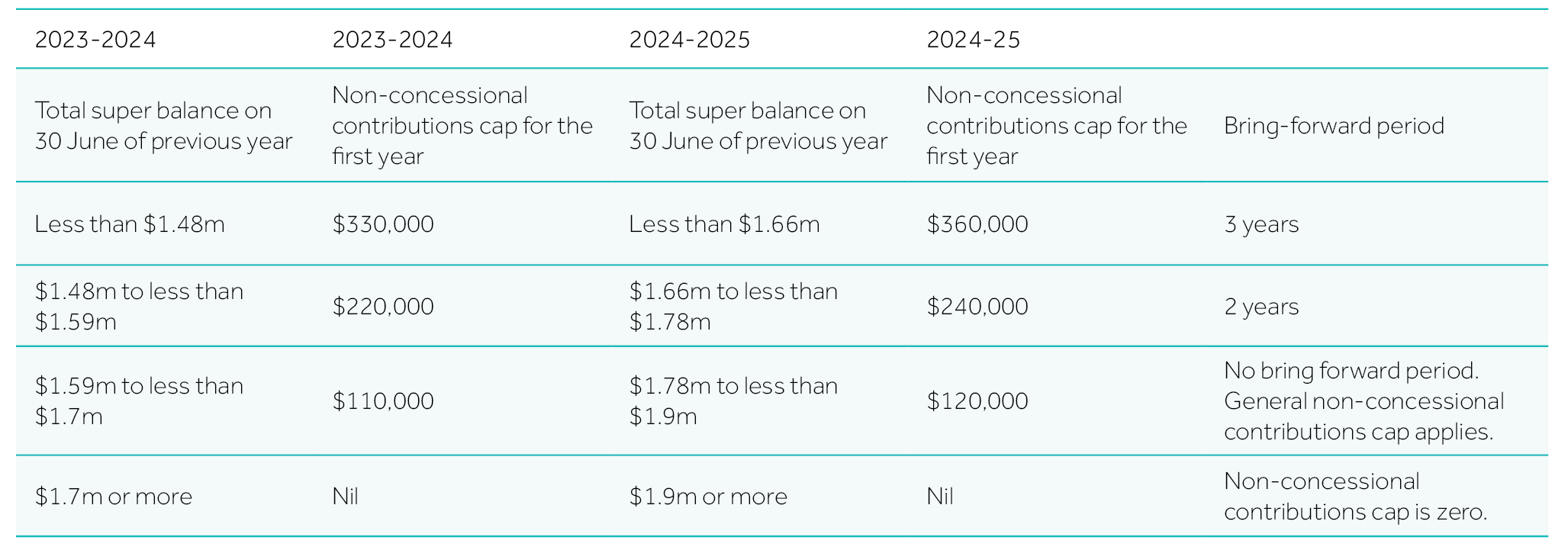

Bring forward periods and caps for non-concessional contributions.

In addition the member must be under 75 at some time during the tax year.

<< Back to Superannuation Solutions | Edition 21